Case study: DocShipper

Collecting payments from international clients and keeping costs under control

DocShipper was founded in 2019 by two brothers, Nicolas and Pierre Rahme. Originally, the company operated as an international forwarder.

But, as the company grew, it started offering clients a one-stop solution to cover the full import-export cycle, from sourcing to international freight, storage and distribution services.

Along with its extensive network ensuring high-quality procurement channels and reliable transportation routes (via air, sea, rail, and road), DocShipper offers each of its clients tailored solutions to meet their unique needs. By doing so, it's set itself apart from traditional logistics operators.

Logistics and supply chain

Fonded in 2019

20+ employees

Asia, Europe, North America

Usages

Incoming and outgoing payments,

Spot foreign-exchange transactions

Currencies

CNY, EUR, GBP, THB, USD

The challenge

Streamlining costs and managing foreign currency

transactions

From the very beginning, DocShipper had to deal with foreign currency transactions. With offices across Asia and Europe, headquarters in Hong Kong, and clients all around the world, the company needed to handle international payments in multiple currencies.

The company was losing more than 5% of its margin on currency exchange fees and transaction costs. The COVID-19 pandemic took a severe toll on the freight transport industry, which made the situation worse by causing prices to soar.

The logistics industry is timesensitive, and paying suppliers on time is critical, according to CFO Charley Hoche:

"In logistics, it’s all about timing. An incorrect payment means the order is canceled and we have to wait two weeks for the next boat. We can’t afford the slightest delay."

Our FX and transaction fees were astronomical. Our main concern was to cut costs.

CFO of DocShipper

Charley Hochet

The solution

A reliable payment platform and personalised support accelerate DocShipper’s growth

If a supplier asks me where their payment is, I can easily track it with the Payment Tracker. And with SWIFT payment messages, I have a trustworthy proof of payment.

CFO of DocShipper

Charley Hochet

The result

Seamless international transactions, contained costs and increased competitiveness

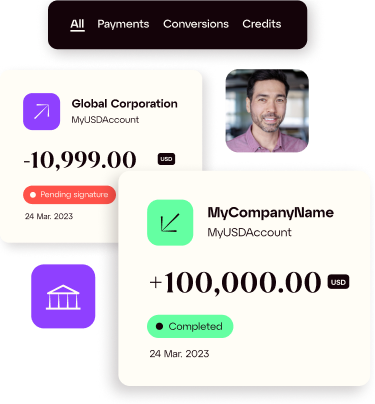

iBanFirst has changed the way DocShipper manages its international transactions. The online platform is "incredibly easy to navigate" according to Hochet. He uses it daily to manage incoming and outgoing payments and always gets competitive rates. "It has become our main account. We use it like a traditional bank," says Hochet. Using iBanFirst has given DocShipper back control of payment execution and FX-related costs, but also given the company a significant competitive edge.

By opening accounts in several currencies, DocShipper allows its clients to make payments in the currency of their choice — without having to worry about foreign exchange rates.

We can invoice our customers in their local currency. This is a huge advantage for us because there are very few players in the market who have this flexibility. It’s a real bonus to know that our customers won’t have to worry about exchange rates.

CFO of DocShipper

Charley Hochet

What makes iBanFirst different is the customer care. I always get very quick answers from my Account Manager. At iBanFirst, we’ve found a partner who understands our business model, its limitations and its needs, and who will support us as we grow.

CFO of DocShipper

Charley Hochet

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.