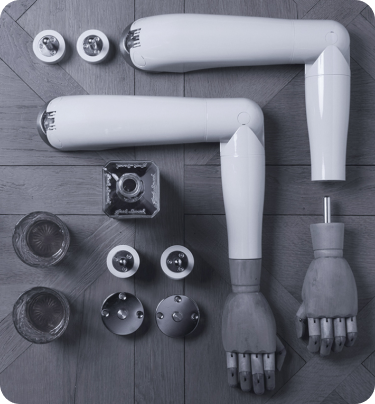

Four out of five display mannequins in Dutch shops are from Hans Boodt Mannequins. The company designs, develops and manufactures display mannequins for shops, department stores and chains. Over 40 years of proven industry experience in retail, wholesale, visual merchandising and concept development, has enabled Hans Boodt Mannequins to create display mannequins that each have their own distinctive charisma. After all, every brand needs its own character.

Headquartered in the Netherlands, Hans Boodt Mannequins has grown to become a global player, partnering with a wide range of fashion companies, from local ones like WE, Shoeby, Rituals and Hema to major international brands like Nike, The North Face, PvH and Lacoste.

Display mannequins

Founded in 1997

35+ employees

Worldwide

Usages

Managing currency risk inherent to goods produced in countries where payment in dollars is standard.

Currencies

EUR, USD

The challenge

Finding a smart way of dealing with currency risks inherent in international payments

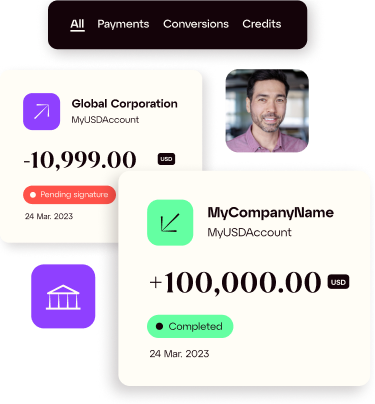

Much of Hans Boodt’s production takes place in China. “We need $15-20 million a year to cover purchases. A sharp rise in the value of the US dollar against the euro, as was the case in 2022, can have a major impact on our

operating costs. To prevent dollar fluctuations from having so much influence on our earnings, we were seeking a way to mitigate currency risk in a smart way,” says Hans van Meerten, CFO of Hans Boodt Mannequins.

The solution

Dynamic forward payments for favourable exchange rate with upside potential

The currency specialists at iBanFirst took the time to walk us through the different options. We then mapped out a strategy to exchange a given amount in dollars every week for a year through dynamic forwards. That’s how we’re guaranteed a fixed exchange rate, which can sometimes be even more favourable when the exchange rate falls within a certain range. The currency strategy we established for 2022 with iBanFirst has proven to be very beneficial for us.

CFO

Hans van Meerten

The result

A currency strategy that ensures peace of mind

“Since we’ve been working with iBanFirst we have a dedicated Account Manager to assist us with currency issues at the drop of a hat. It’s a refreshing change from our main bank.

iBanFirst’s expertise enabled us to enjoy favourable exchange rates and a nice financial benefit. A good currency strategy also brings a lot of peace of mind for a company. It gives us more time to work on other projects and notably how we want to position ourselves in the future. Currently, a large portion of our mannequins are made in China so we’re doing trials with 3D printers to enable us to manufacture display mannequins closer to our customers. Turning to local 3D printing will also enable us to produce less residual waste, so that we can make a big impact in terms of sustainability which is a major focal

point in our business strategy,” says Hans van Meerten.

Apart from financial benefits, a good currency policy also gives a lot of peace of mind within the company.

CFO

Hans van Meerten

We can contact our dedicated Account Manager at the drop of a hat. It’s a refreshing change from our main bank.

CFO

Hans van Meerten

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.