Case study: Blisce

Taking back control of payments and associated fees in foreign investments

Co-headquartered in New York and Paris, Blisce is an international investment management group that focuses on private equity and venture capital opportunities. Founded in 2014 by serial entrepreneur Alexandre Mars, Blisce invests in mission-driven global consumer brands, technology companies and startups.

Since its founding, Blisce has invested in leading US and European companies, including Spotify, Pinterest, Brut, Too Good To Go and more.

Investment fund

Founded in 2014

25+ employees

France and the USA

Use case

Incoming and outgoing payments

Spot foreign currency transactions

Currencies

EUR, USD

The challenge

Managing multiple currencies and optimising transactions

Approximately 70% of Blisce’s investments are made in the US, where it has a subsidiary, and the remainder in Europe. Its US footprint and investment activities expose Blisce to fluctuations in the euro-dollar exchange rate.

“When I joined Blisce, I quickly realised we had a huge volume of transactions flowing from France to the US, meaning lots of euro-to-dollar exchanges, all handled through a traditional bank. Since I was familiar with iBanFirst’s offering, I wanted to get a clear view of the fees our bank was charging for payments, but the information was frustratingly opaque," explains Anne-Claire Colomb, Chief Financial Officer at Blisce.

She was keen to regain control over exchange rates and transfer fees for investment operations and inter-company transactions, like paying invoices and US salaries. She also wanted peace of mind that payments would be made on time and without any hiccups.

Whenever we invest in a company, it's crucial for us that funds arrive on time.

CFO at Blisce

Anne-Claire Colomb

The solution

Transparent exchange rates paired with dedicated customer support

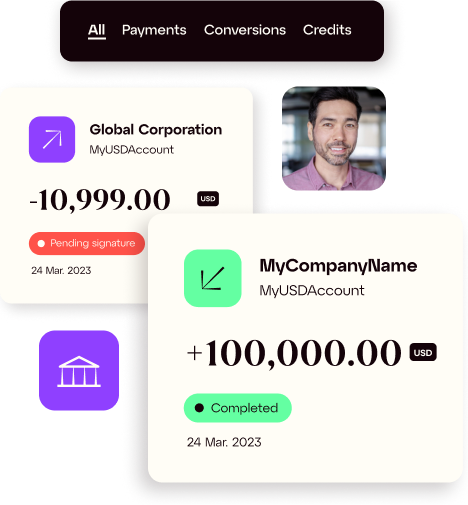

By choosing iBanFirst, Anne-Claire can access real-time exchange rates and gain complete visibility of transaction fees before she makes a payment.

She benefits from fast, seamless payments, confirmed in just one click via the iBanFirst platform. It’s become Blisce’s go-to tool for handling all international payments.

"We receive SWIFT payment confirmations in just 30 minutes. With a traditional bank, it takes three to four hours! Plus, we can share payment confirmation emails directly with the recipient, making the whole process more transparent both for us and our beneficiaries."

Beyond the payment solutions, Anne-Claire can also rely on her dedicated iBanFirst account manager for support. “If we ever need help or have a question, we can always call or email our account manager and they respond in record time — something you just don’t get with a traditional bank.”

I know exactly how many dollars I am buying for my euros. I know in advance how much I will be charged and what exchange rate will be applied. No more nasty surprises! The amount sent to the beneficiaries is guaranteed.

CFO of Blisce

Anne-Claire Colomb

The result

Smooth, cost-effective transactions and increased competitiveness

With instant currency payments, competitive rates, and transparent pricing — all validated in a single click — Blisce has streamlined its foreign currency transactions while keeping costs under control.

"As CFO, I feel reassured by how efficiently my payments are processed with iBanFirst, especially during deal closings when every second counts," says Anne-Claire.

Thanks to iBanFirst, Blisce has simplified its international payments and built trust with its partners.

-1.png)

iBanFirst has taken a huge amount of stress off my shoulders when it comes to foreign currency transfers by making cash flow management easier and significantly improving our relationships with beneficiaries.

CFO of Blisce

Anne-Claire Colomb

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.