Case Study: Forza Refurbished

A second life for Apple products

Founded in 2016, Forza Refurbished sells used and refurbished Apple products and is just as serious about sustainability as it is about financial results.

"Our operations reflect our sustainable conviction”, says Financial Director René Vergeer. “Because we believe in a circular economy. It's wasteful in so many ways if iPhones and iPads end up in the waste cycle. And the market for products like ours is growing extremely fast."

Reseller, Apple products

Founded in 2016

275+ employees

Europe

Use case

Managing exchange rate risks arising from importing goods from overseas.

Currencies

EUR, USD

The challenge

Buying in dollars, selling in euros

Forza Refurbished imports iPhones and iPads from the United States and then sells them in the Netherlands. Due to rapid growth, the company increasingly faces foreign currency risks.

We pay upon receipt of the goods, but can only arrange financing when the products are actually in stock. If the euro-dollar exchange rate takes a significant swing in the meantime, it can make the difference between profit and loss for us.

CFO

René Vergeer

The solution

A smarter structure with a limited security deposit

The combination of rapidly growing turnover and the cyclical nature of currency risks made finding a tailored solution a real challenge — until Forza came across iBanFirst.

"Thanks to our currency policy, I now look at the dollar very differently. In the past, I worried when the currency rose. Now I actually hope the dollar rises a bit more, because that would bring us some extra money. I can already tell you that we'll set up a similar structure with iBanFirst next year as well."

CFO

René Vergeer

The result

Currency issues that don't distract from the company's sustainable focus

Thanks to the partnership with iBanFirst, Forza Refurbished's currency issues don't distract from their core activities: selling second-hand iPhones and iPads in the most sustainable way possible.

"We operate from a sustainable conviction. We do this because we believe in a circular economy. It's wasteful in many ways if iPhones and iPads unnecessarily end up in the waste cycle."

CFO

René Vergeer

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

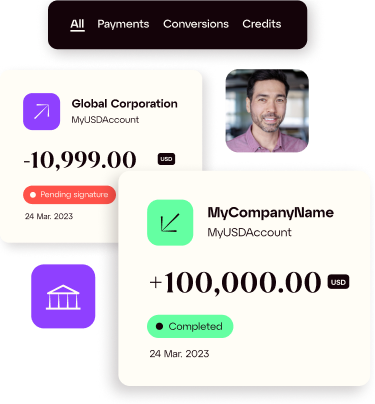

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.