Case study: Lendahand

Optimising financial operations through strategic currency management

Today, 736 million people live on less than €1.60 a day. Creating new jobs helps people escape poverty. That insight prompted former equity analyst Peter Heijen to found Lendahand. The crowdfunding platform connects Dutch investors seeking social and financial returns with small businesses that are driving the economy in developing countries.

For Finance Director Daniël van Maanen, Lendahand aims to bridge the gap between "Dutch investors who want to invest socially and the entrepreneurs in developing countries that need funding. With already nearly 3,000 projects, we’ve been able to help a lot of entrepreneurs get a loan for working capital or to purchase equipment such as solar panels, for example. Since we started in 2013, we’ve already helped provide more than €100 million in loans."

Once projects reach their funding goals, investors receive regular principal repayments along with interest on their initial investment. Upon receiving repayments, investors have the option to reinvest in other projects or withdraw their funds, with no additional charges, back into their bank accounts.

Impact investing / crowdfunding

Founded in 2013

25+ employees

Netherlands & developing countries

Use case

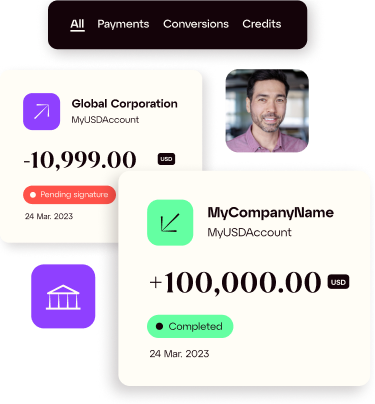

Managing transaction risk when lending and receiving credit in dollars.

Currencies

EUR, USD

The challenge

Investors deal in euros, but entrepreneurs prefer to borrow in dollars

To bring lenders and entrepreneurs in emerging countries together, Lendahand often has to bridge currency markets. Investors deposit the money in euros, but loans for projects in emerging countries are generally in dollars or local currencies.

Daniël van Maanen explains: "We were looking for a way to convert the euros that investors were looking to lend into dollars. Upon repayment, the amount would then need to be converted back to euros. For us, these conversions were quite complex, as all our systems are set up for euros. We didn’t know how to handle these money transfers from one currency to another without being disadvantaged by the fluctuating exchange rates."

iBanFirst has a very customer-driven approach, which makes working with them an enjoyable experience. We sometimes had a few specific requests for which there was no ready-made solution but they saw this as a challenge. In fact, I've never heard them say something is impossible!

CFO of Lendahand

Daniël van Maanen

The solution

Close cooperation and a tailor-made system

iBanFirst set up a currency strategy specifically tailored to Lenahand’s needs. For example, transactions can sometimes take days to settle, but by setting up flexible forward payments, Lendahand can lock in an exchange rate, often getting a slightly better rate in the process.

The result

Rapid growth thanks to many more dollar transactions

In early 2021, Lendahand made it possible for its Dutch investors to invest directly in dollars. Things have moved fast since then.

"Now that we can fund loans in dollars, many projects have become available to investors on our platform. In the first year, 15% of our loans were granted in dollars. This year, it’s already reached 50%. It’s such a great success that we’ve even had to slow things down a little."

Over the past year and a half, the dollar has risen against the euro. And as a result, investors have made additional returns. But if and when the dollar falls, it could pose a problem for Lendahand and its investors, which is why locking in rates is crucial.

We were looking for a way to manage the risk of currency fluctuations affecting returns, and iBanFirst had the solution. Now, we’re better able to serve our customers and we hope to process a total of €1 billion worth of loans by 2026.

CFO

Daniël van Maanen

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.