Case study: Van der Linde

Simplifying cross-currency payments for smooth business operations

Van der Linde Catering + Events provides food, drinks and stylish hospitality for all kinds of occasions. From intimate family dinners at home to large parties, the Rotterdam-based family business has been working hard for over 60 years to make every event a special moment to remember.

Director Hans van der Linde explains: “My grandfather and my father started one of the first lunchrooms in the Netherlands in Rotterdam over 60 years ago. Since then, we have grown into a mature SME with around 20 permanent staff.”

Catering services

Founded in 1962

20+ employees

Netherlands & Dubai

Use case

Incoming and outgoing payments

Currencies

EUR, AED, JPY

The challenge

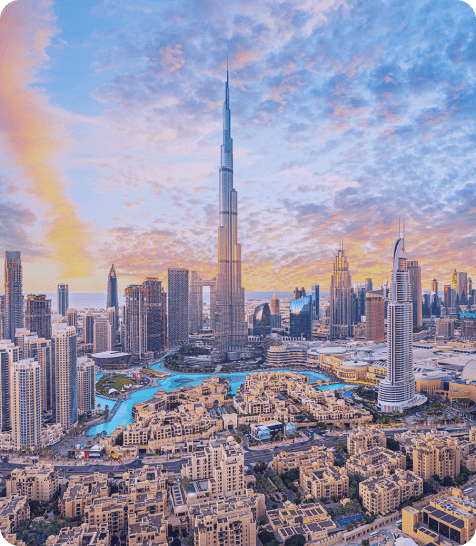

Incoming and outgoing payments in dirhams for a contract in Dubai

In 2020, Van der Linde was selected by the Dutch government to cater at the Dutch pavilion at the Expo 2020 in Dubai, where over 190 countries and organisations participated. Besides daily catering, Van der Linde managed events and VIP receptions. The task was complex. This event marked their first assignment outside of Europe, and everything had to be sourced locally, including staff.

We needed to find a quick, cost-effective way to handle all payments and receipts in Emirati dirhams (UAE).

CEO

Hans van der Linde

The solution

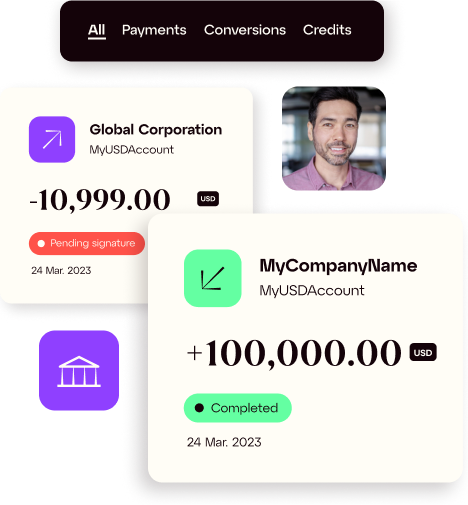

A multi-currency account and the expertise of a dedicated specialist

Initially, I knocked on the door of our main bank, but currency trading is not one of its core activities. On the recommendation of a business partner, I got in touch with iBanFirst.

Opening a multi-currency account was hassle-free — much easier than applying for a regular bank account. Plus, the personal support from iBanFirst specialists who understand my business is refreshing compared to automated bank helplines.

CEO of Van der Linde

Hans van der Linde

The result

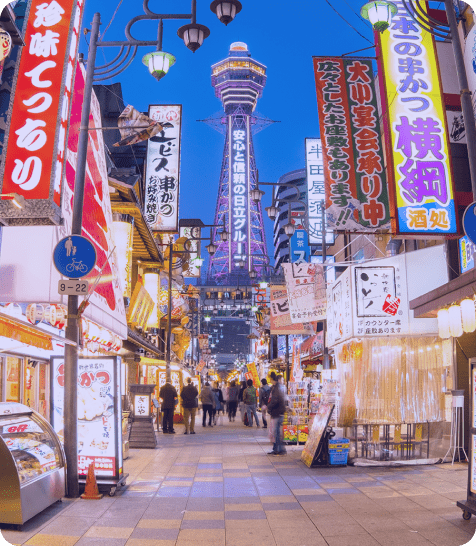

Soon to be doing business in Japanese yen in Osaka?

Partnering with iBanFirst enabled Van der Linde to do business in UAE dirhams and exchange the balance back to euros at the end of the event without any problems. It was so hassle-free, Hans van der Linde has continued to work with iBanFirst ever since.

The next World Expo will be held in Osaka in 2025. "We’ll be catering for the Dutch pavilion again and will use iBanFirst to see how we can do smart business in Japanese yen," he concludes.

Once a week, I log on to make all payments and check incoming payments — all very easy to do on the iBanFirst platform.

CEO of Van der Linde

Hans van der Linde

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.