Case study - Hircus

Accelerating textile imports thanks to reliable international payments to suppliers

Hircus was launched in 2014 as a genuine alternative within the fashion industry to sell high-quality cashmere sweaters without a sales intermediary. Jean-Nicolas Payart and Louis-Erard Bataille, the brand’s founders, are seeking to offer a different cashmere from most cashmere products available on the market, which are often considered too expensive and of disappointing quality.

"At Hircus, each model is designed in Paris and then produced by carefully selected workshops with whom we have established strong and lasting ties. Known for their exceptional raw materials and remarkable expertise, they allow us to offer timeless items of irreproachable quality."

Hircus’ hallmark is the quality of its cashmere. The company sources its fine wool in Asia, and more specifically in the heart of the Gobi Desert in China, where the world’s best suppliers can be found. This is the natural habitat of Capra Hircus goats that can survive temperatures of -40°C in winter and produce the wool required for premium cashmere.

While the quality of the raw material is a top priority, reliable and regular supplies are essential for the brand. Hircus needs to obtain items rapidly and to optimise the supply chain.

This is where iBanFirst comes in.

Textile, clothing

Founded in 2014

20+ employees

Asia, Europe

Use cases

Outgoing and incoming payments

FX spots

Risk management with forward payment contracts

Currencies

EUR, USD

The challenge

Buying in Asia, accelerating distribution in Europe, with no intermediaries.

For Hircus to be able to provide fair prices to its customers by eliminating sales intermediaries it needs to establish a fluid, responsive and optimised supply chain.

To ensure good relations with suppliers, trust is essential. Time is a key factor in building trust, as the business relationship grows gradually. But it is not the only one. What concrete measures can a buyer take to create trust?

One of the biggest challenges that suppliers face is payment times. Their treasury is impacted when production is launched, and actual expenses are incurred. Production does not start until payments have been at least partially received.

The same goes for carriers. Merchandise is not sent out until payments have been credited to bank accounts. This provides protection against delays or even missed payments, which are common in international trade.

After three years in business, Jean-Nicolas Payart, Hircus’ co-founder, reached the limits of what traditional banks can offer when managing a key point: the speed of international foreign-currency payments.

We always need payment confirmation before the supplier releases the merchandise. And with our bank partners, there was always a one-week delay. This was very limiting, especially as I was unable to track payments as they passed through different intermediary banks. It made it impossible for us to be transparent with our suppliers on this issue.

Co-Founder of Hircus

Jean-Nicolas Payart

The solution

A reliable platform to manage foreign-currency payments with ease & speed.

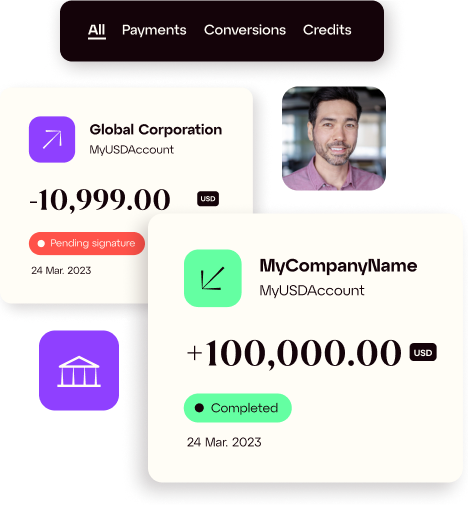

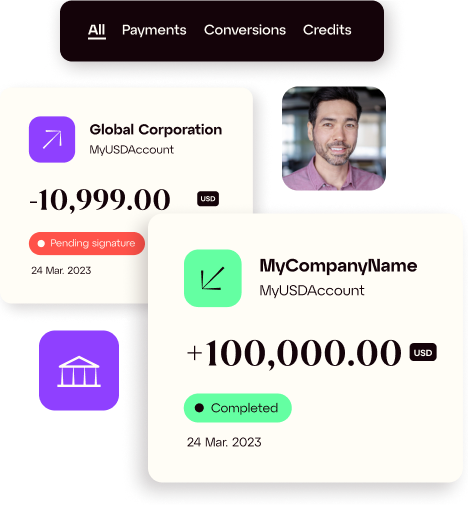

To optimise the speed of its payments and ensure imports are received on time in a clothing sector marked by sharp seasonal fluctuations, Hircus’ management has chosen iBanFirst.

"As the co-founder, I am responsible for supplier payments in foreign currencies. I do not have a dedicated team member or department to handle this. Spread out over a year, I make about one payment per month, in fact, the vast majority of our payments happen in the autumn and winter months. And that’s when I need as much simplicity and reliability as possible."

Jean-Nicolas has discovered other benefits of using the iBanFirst platform. Beyond speed of payment, the platform simplifies international payments by reducing administrative management to the bare minimum.

Above all, he gained his suppliers’ trust at the same time:

As the co-founder, I am responsible for supplier payments in foreign currencies.

Spread out over a year, I make about one payment per month, in fact, the vast majority of our payments happen in the autumn and winter months.

And that’s when I need as much simplicity and reliability as possible.

Jean-Nicolas Payart

The result

Speeding up transactions, and a guarantee against currency volatility

Hircus intends to continue growing and expanding its sales in Europe. Imported volumes are also set to grow and the EUR/USD exchange rate will become more and more important for the company, as payment volumes will automatically increase.

To deal with this growing risk of currency volatility, Hircus has already begun using iBanFirst’s risk management solutions: forward payment contracts that block an exchange rate on a currency pair. If the exchange rate weakens, it is possible to “block a budget exchange rate” to guarantee real gross margins.

"We are seeking to buy dollars more thoughtfully. This has been difficult this year, as nobody predicted such a steep fall in the euro against the dollar. For next year, we hope to do better with a partial risk management strategy of our dollar flows, while maintaining flexibility by combining this strategy with spot currency operations. This will allow us to react better in all circumstances in an inherently unpredictable currency market."

To achieve this, iBanFirst provides the assistance of a dedicated account manager and macroeconomic information transmitted in real time to help companies like Hircus take the right decisions to protect themselves against currency risk.

The big advantage of iBanFirst is the speed of payments and conversions. I pay my Asian suppliers in US dollars, and I know that the funds will be on their accounts in 24 hours.

Co-Founder of Hircus

Jean-Nicolas Payart

I do not even have to use iBanFirst’s Payment Tracker function as my suppliers receive a notification informing them that the transfer has been sent.

The next day, the funds are on their account. I have never had any problems. International payments are no longer a concern for me.

I know the process is reliable and my suppliers know I’m trustworthy.

Co-founder of Hircus

Jean-Nicolas Payart

Frequently asked questions

Who can open an account with iBanFirst?

Any individual or company with international and foreign exchange payment volumes of more than €80,000 per year is eligible to open an iBanFirst account. Restrictions may apply depending on the country of origin, the activity of the company, or the origin of the funds.

Fill out the account opening form to be contacted by an advisor.

What does the process of opening an account look like?

Opening an account with iBanFirst is a 100% paperless process.

-

Fill out the account opening form to be contacted by an iBanFirst adviser.

-

Send us the documents identifying your company and its beneficial owners.

-

Our customer support team will set up your account, so you can be up and running right away.

-

You will need to activate your iBanFirst account by making a first transfer from your main bank account.

-

Your account will be ready to use upon receipt of this activation transfer.

How much does it cost?

Unlike most corporate banks, iBanFirst does not charge fees or commissions on currency conversions.

The only fees iBanFirst charges are payment fees. Payment fees are fixed, but vary depending on the payment network, speed and payment instructions chosen. They are clearly displayed when a payment is created and users can choose between different payment options.

Companies below the minimum annual threshold of €200,000 in currency payments incur a variable fee of 0.2% of incoming payments and transfers without currency exchange.

Other ad hoc fees may apply for iBanFirst to handle exceptional requests

Are my funds secure?

Protecting your account from fraud:

iBanFirst ensures the security of its customers' accounts through numerous measures such as a robust infrastructure, SSL encryption of connections, and regular audits and computer penetration tests.

Strong Authentication:

Strong authentication is a mandatory security measure for sensitive actions such as:

-

Logging into the platform from a new device

-

Adding a beneficiary

-

Validating a payment or a currency conversion

-

Adding a user

Strong authentication ensures the security of your account and funds if your platform credentials are ever compromised. The strong authentication methods available at iBanFirst are:

-

One-time code generated by mobile or desktop applications such as Google Authenticator or Authy

-

Yubikey

These methods are both used in a process called two factor authentication (2FA). They will ask you to authenticate using both something you know (your iBanFirst credentials) and something you have in your possession (your phone or Yubikey) .

What currencies does iBanFirst offer?

With iBanFirst, you can open accounts in more than 35 currencies, with nominative IBANs that guarantee the security and quality of your payments.

Go check our Currency Reference Center

How much money can iBanFirst make me save?

Since 2013, iBanFirst has been analyzing exchange rate changes and fees charged by banks on foreign currency transactions and has developed a bank fee calculator.

How much do your foreign currency transactions cost you today with your bank? How much could you save with iBanFirst?

Do the simulation here.